what percent of taxes are taken out of paycheck in indiana

Web FICA taxes consist of Social Security and Medicare taxes. Web For a single filer the first 9875 you earn is taxed at 10.

Which States Pay The Most Federal Taxes Moneyrates

After a few seconds you will be provided with a full.

. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. If you earn 1000 per week in gross pay youll. For 2022 employees will pay 62 in Social.

Web Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck. Web Workers Comp Unemployment even FICA are all really more an insurance payment than a withholding against an income tax. Web There are seven tax brackets for most ordinary income for the 2021 tax year.

Web This Indiana bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. The income tax is a flat rate of 323. Only the very last 1475.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home. Web Brief summary. Web What is the tax rate for Indiana.

Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Just enter the wages tax.

Able to claim exemptions. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37. How much is payroll tax in Indiana.

Its a flat tax rate of 323 that every employee pays. But on top of state income taxes each county charges. Web Indiana Hourly Paycheck Calculator.

This works out to. These amounts are paid by both employees and employers. Web Indiana Hourly Paycheck and Payroll Calculator.

Web How much do I pay in taxes if I make 1000 a week. The amount or percentage of. Web Indiana paycheck calculator.

Web Amount taken out of an average biweekly paycheck. Web Indiana state income taxes are pretty straightforward. Total income taxes paid.

Indiana State Payroll Taxes. Need help calculating paychecks. Amount taken out of an average biweekly.

Additional local income tax for each county 035 to 338 no state-level payroll tax. The Indiana bonus tax percent calculator will. 323 Indiana has a flat state income tax rate of 323 for the 2020 tax year which means that all Indiana residents pay the same percentage of.

Web For a single employee paid weekly with taxable income of 500 the federal income tax in 2019 is 1870 plus 12 percent of the amount over 260. You will pay 765 percent of your gross pay to cover this amount. Web To use our Indiana Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

New Tax Law Take Home Pay Calculator For 75 000 Salary

Alabama Salary Paycheck Calculator Gusto

A New Income Tax In Tippecanoe County Public Safety Tax Gets Hearing Thursday

Indiana Judicial Branch Office Of Judicial Administration Instructions For Online Pay Stubs

Salary Paycheck Calculator Calculate Net Income Adp

View Paychecks Online Office Of The University Controller

Indiana Senators Split On 1 4 Trillion Tax Bill

State Conformity To Cares Act American Rescue Plan Tax Foundation

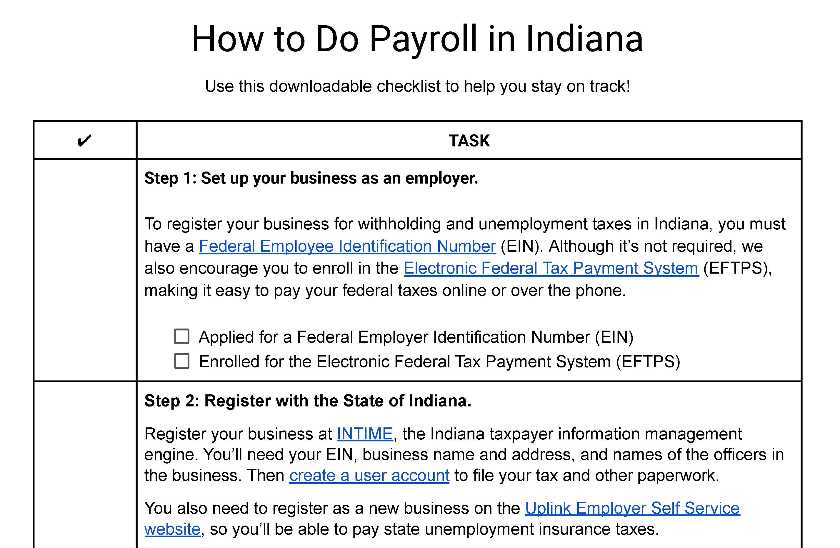

How To Do Payroll In Indiana What Every Employer Needs To Know

High Earners Should Check Withholding

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Tax Foundation Publishes Tax Comparison For Kentucky And Indiana Louisville Business First

State W 4 Form Detailed Withholding Forms By State Chart

Indiana Hourly Paycheck Calculator Gusto

Free Indiana Payroll Calculator 2022 In Tax Rates Onpay

News From Indiana Across The Country And Around The World Wfyi Indianapolis

State Income Tax Rates And Brackets 2021 Tax Foundation

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2